Pop-up stores are everywhere these days — but how many of them are actually strategic?

Last week, I visited the Musinsa Festa 2025 in Seongsu, one of the most talked-about brand events of the season.

It wasn’t just visually impressive — what truly stood out was how intentional everything felt: from pre-registration to platform execution to offline logistics.

Let’s break it down.

The Strategy: Not Just Another Pop-Up

The one strong point I’d like to highlight is Musinsa’s pre-registration process before opening the pop-up, paired with a well-orchestrated online marketing campaign that spanned multiple channels:

- Meta ads

- Organic social content

- Naver display ads

- Influencer and celebrity collaborations

- Offline promotions (flyers, outdoor placements)

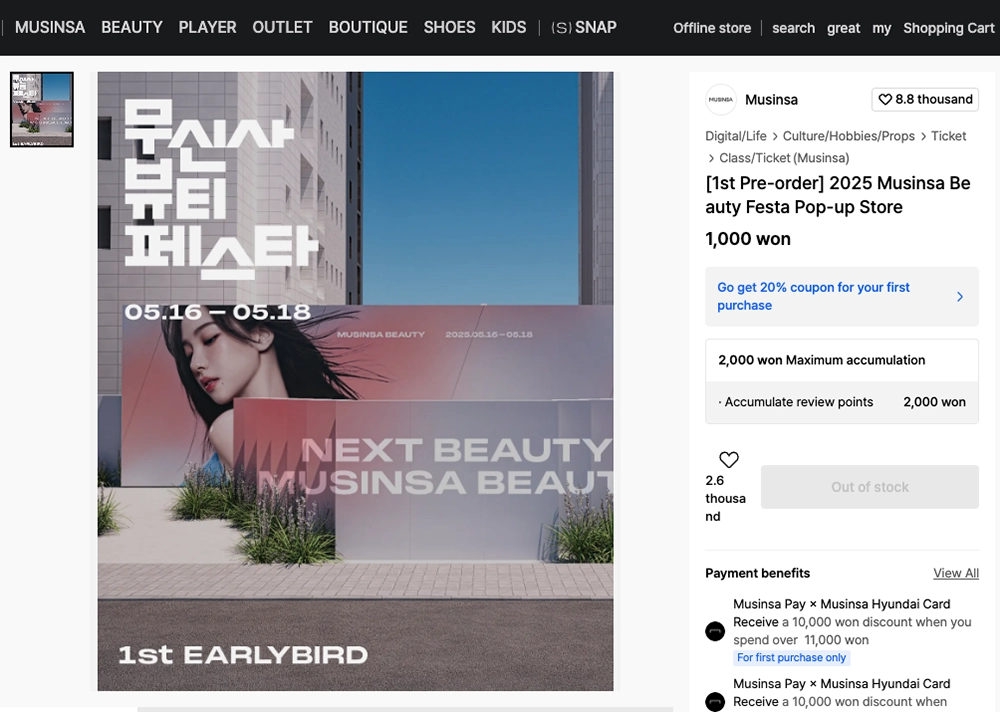

To enter the pop-up, attendees had to purchase a ticket (~$1) — a small amount, but one that added perceived value and helped filter for intent-driven visitors.

Interestingly, last year’s Musinsa pop-up also used a similar model, though tickets were priced higher (around $15). Regardless of price, people showed up — drawn in by the chance to experience curated brand activations and collect free samples from participating beauty brands.

This year, walk-in registration was allowed, but when I visited on Sunday, all slots were already filled by 1 PM.

In total, they opened three different locations with over 45 rising brands, including:

- Musinsa Square Seongsu 4

- Musinsa Beauty Space 1

- Musinsa Store Seongsu @ Daelim Warehouse

This was not a casual pop-up — it was a conversion funnel in physical form.

Why Everyone Wants a Piece of Korea’s Beauty Market

It’s no coincidence that Musinsa, a fashion powerhouse, is expanding into beauty — and they’re not the only ones.

Olive Young, Korea’s dominant beauty retail chain, continues to expand into the U.S., Japan, and beyond. Meanwhile, Beauty Kurly (a division of Kurly Corp, best known for grocery delivery) is emerging as another strong competitor in this space.

The retail landscape is shifting:

Olive Young vs. Beauty Kurly vs. Musinsa.

But for now, it’s clear: Olive Young is still leading, especially as others are still relatively new to the category.

So why is everyone getting into beauty?

- Beauty products sell year-round, unlike fashion or food, which are more seasonal.

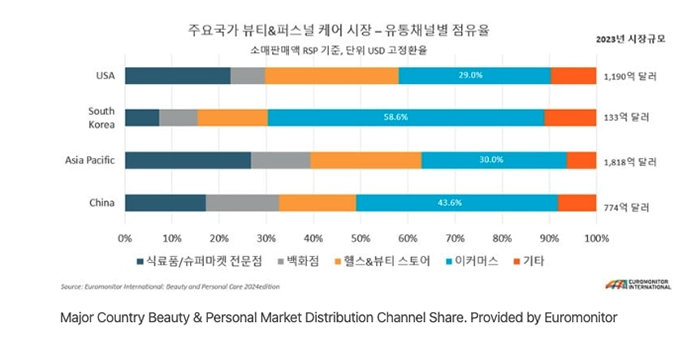

- Korea ranks #1 globally in e-commerce penetration for beauty and personal care — with 58.6% of purchases made online.

For any brand looking to enter or grow in Korea, the beauty market offers stable demand, loyal audiences, and strong digital buying behavior.

What This Pop-Up Store Made Me Think About...

What surprised me is that so many other pop-up stores don’t follow this kind of strategic structure.

No clear marketing campaign. No smart pre-registration flow. No thought given to whether visitors should pay to attend or how to create actual scarcity or anticipation.

Instead, I often see pop-ups hoping to grab random people off the street — chasing foot traffic with no targeting or message.

But a successful pop-up is never just about footfall.

- Targeting the right audience

- Building a clear concept

- Designing a thoughtful customer journey

- Creating brand moments people remember (and share)

Fix just one or two of these?

Your ROI and brand impact can improve dramatically.

Final Thoughts

The Musinsa Festa 2025 wasn’t just a fun weekend activity — it was a masterclass in pop-up design with a clear funnel, clear value exchange, and clear brand positioning.

If you’re planning a launch or brand activation in Korea, the question isn’t just “What will it look like?”

It’s:

“How intentional is this strategy from start to finish?”

— Hyein

P.S. How launch-ready are you?

Grab our [90-Day Korea Launch Checklist] and make sure you’re not missing a step.

This playbook cuts through the noise and gives you the blueprint to enter with impact.