If you’re planning to enter the Korean market, one of the first questions you should ask is:

“Where do Korean consumers actually make their purchase decisions?”

In this post, we break down three key platforms – Naver Clip, Instagram, and YouTube – and explore how Korean users behave on each, what drives conversion, and which platform fits which type of customer best.

We also share two distinct buyer personas in their 30s, a quick case study from an Australian skincare brand, and updated Naver marketing resources to help you build a locally optimized strategy.

Let’s dive in!

Let’s start by understanding one thing that sets Korea apart:

When something goes viral here, it doesn’t just trend here – it explodes.

In early 2024, a creamy bite-sized dessert known as “Dubai Chocolate” went viral on TikTok and Instagram in Korea. Originally a Middle Eastern-style treat, it quickly became a trending item in Korean convenience stores and marketplaces – selling out in days after social media creators jumped on the hype.

This kind of trend cycle happens often in Korea – from skincare products and drinks to fashion collabs and even convenience store snacks.

💡 So if you’re not in the loop, or your brand isn’t showing up at the right moment, you’re out.

That’s why understanding how trends spread and how different consumers engage with them is critical – and not every consumer behaves the same way.

Two Buyer Personas You Need to Know

To build the right platform strategy, you first need to understand who you’re actually targeting.

Even among women in their early 30s, we see two very different behaviors based on how they engage with digital content and make purchase decisions.

Here’s a breakdown of the two most common personas we see in the Korean market:

👩 Persona A: The Active Social Media Explorer

She’s constantly connected.

She scrolls Instagram Reels, keeps up with trends on YouTube Shorts, follows her favorite influencers, and saves products she’s interested in.

She makes impulse purchases based on what she sees in the moment, especially if the content is visually strong, trendy, or endorsed by someone she trusts.

- Where she hangs out: Instagram, YouTube, Naver Shopping tab

- What influences her: Trend-driven content, aesthetic visuals, influencer credibility

- How she buys: Quick decisions, mobile-first, often through direct links or in-app purchases

🙅 Persona B: The “No-Instagram-Please” Researcher

She’s intentionally disconnected from Instagram.

She finds it overwhelming and even a bit toxic. But that doesn’t mean she’s out of the loop.

She actively searches for what she needs on Naver or Google, watches YouTube hauls and reviews, chats with friends on KakaoTalk, and trusts word-of-mouth more than ads.

- Where she hangs out: Naver search, YouTube, KakaoTalk

- What influences her: Peer reviews, blog posts, comparison content, long-form reviews

- How she buys: After research, often through trusted retailers or recommendations

Now here’s the interesting part.

Despite their differences, both of these personas search before they buy.

Whether they’re trend-driven or research-focused, Naver often plays a central role in their decision-making.

That’s why having a presence on Naver isn’t optional. It’s foundational.

And this is where Naver Clip is becoming a serious game changer.

📈 Why Naver Clip Deserves More Attention

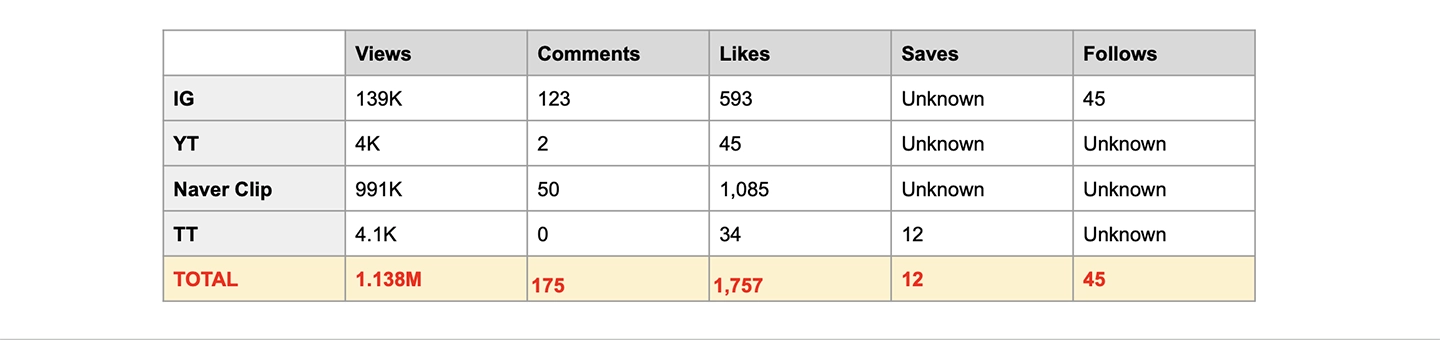

We’ve been closely tracking the performance of Naver Clip content across campaigns. In multiple cases, including one of our recent launches with an Australian skincare brand, we saw stronger impressions, higher engagement, and better conversion flow compared to the same content posted on Instagram or TikTok.

In one case, a single viral clip generated 1.3 million views and created a ripple effect that drove both search volume and purchases through Naver Shopping.

So while Instagram may be more visible at first glance, Naver Clip quietly captures the moment when Korean consumers are actively deciding.

When you pair Naver Clip content with strong presence on Naver Shopping and blog coverage, you’re building a full-funnel system that actually reflects how Koreans shop.

Want to learn how to structure your Naver presence the right way?

In the next post, we’ll explore how YouTube works as both a TV and search engine in Korea, and what kind of content actually builds authority and drives action.

Until then, if you’re planning your Korean market entry and want to make sure your strategy is aligned with local behavior, let’s talk.